Remote transactions and online interactions have become the norm, which means that ensuring the identity and authenticity of customers is crucial. This is where eKYC (Electronic Know Your Customer) steps in, revolutionising the process of customer verification and onboarding. In this article, we will demystify eKYC, explore its benefits, and shed light on its implementation across various industries.

What is eKYC and Why is it Important?

eKYC refers to the use of electronic methods to verify the identity of customers remotely. It leverages digital technologies and automation to streamline the traditional KYC process, eliminating the need for physical documentation and in-person visits. By digitising and automating the verification process, eKYC offers significant advantages in terms of efficiency, speed, and accuracy.

The Challenges and Limitations of the Traditional KYC Process

Traditional KYC processes often involve customers submitting physical copies of identity documents and undergoing manual verification. This approach is time-consuming, prone to errors, and can create friction in customer onboarding. Additionally, it poses challenges in terms of storage, retrieval, and security of sensitive personal information. These limitations necessitated the evolution of customer verification methods, leading to the emergence of eKYC.

Introducing eKYC – How Digitalisation Transforms Customer Verification

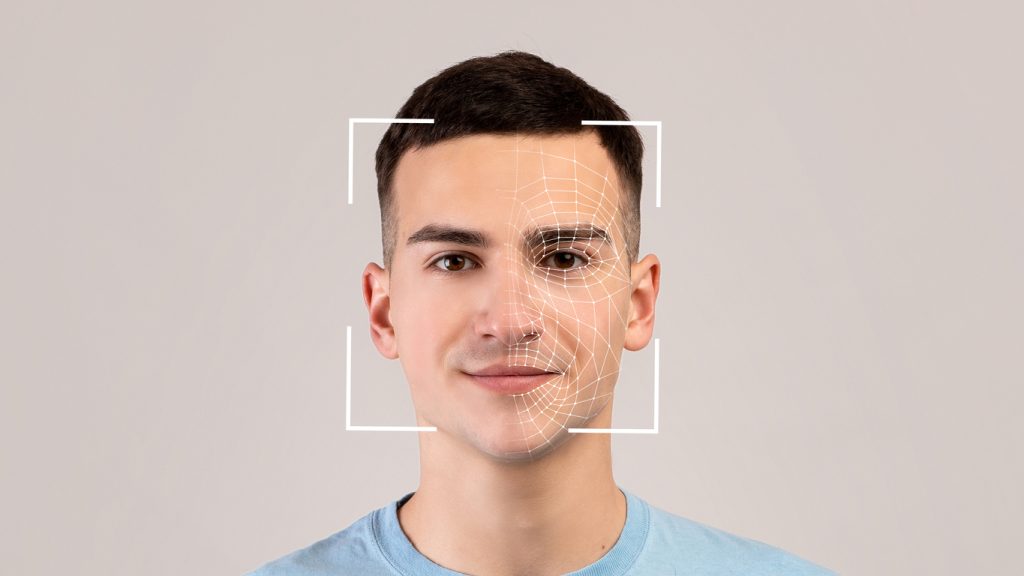

eKYC brings a digital transformation to the customer verification process. It utilises advanced technologies such as biometrics, artificial intelligence, and machine learning to collect, verify, and authenticate customer data electronically. Through secure online platforms, customers can provide their identity information and supporting documents, which are then analysed and compared against reliable databases in real time.

The Key Components of eKYC: Technology and Regulations

eKYC comprises two crucial components: technology and regulations. On the technology front, it involves secure online platforms, data encryption, facial recognition, optical character recognition (OCR), and data analytics. These technologies ensure secure data transmission, accurate document scanning, biometric authentication, and fraud detection. Simultaneously, regulatory frameworks and compliance guidelines govern the implementation of eKYC to safeguard customer privacy and data protection.

eKYC Workflow, from Data Collection to Verification

The eKYC workflow consists of several stages. Firstly, customers provide their identity details, such as name, address, date of birth, and contact information, through a digital interface. They also submit scanned copies or photographs of their identity documents, such as passports or driver’s licenses. Next, the eKYC platform employs OCR technology to extract data from the uploaded documents accurately.

Following data extraction, the system performs a series of verification checks. It validates the authenticity of the document, cross-references the customer’s information with external databases, and conducts biometric matching, if applicable. Once the verification process is complete, the system generates a verification report indicating the success or failure of the eKYC process.

Advantages of eKYC for Businesses and Customers

eKYC offers a myriad of benefits for both businesses and customers. For businesses, eKYC streamlines the customer onboarding process, reducing the time and resources required for manual verification. It enables faster transactions, enhances operational efficiency, and improves customer experience. Additionally, eKYC minimises the risk of human error and strengthens compliance with regulatory requirements.

Customers, on the other hand, benefit from the convenience and speed of eKYC. They can complete the verification process remotely, eliminating the need for physical visits and paperwork. The seamless and efficient onboarding experience enhances customer satisfaction and fosters trust in digital services. Moreover, eKYC reduces the risk of identity theft and fraud, ensuring the security of personal information.

Enhancing Security and Reducing Fraud with eKYC

One of the primary goals of eKYC is to enhance security and reduce fraud in customer verification. The implementation of advanced technologies like AI and biometrics significantly strengthens the verification process. Facial recognition, fingerprint scans, and iris recognition add an extra layer of security by ensuring that the person undergoing verification is the rightful owner of the identity documents.

Furthermore, eKYC systems can detect anomalies and suspicious patterns through data analytics and machine learning algorithms. They can identify discrepancies, flag potential fraud attempts, and trigger additional verification measures if necessary. These capabilities make eKYC a powerful tool in combating identity theft, financial fraud, and other illicit activities.

eKYC in Different Industries

eKYC has found widespread adoption across various industries. In the banking sector, it has revolutionised the account opening process, enabling quick and secure onboarding of customers. Insurance companies leverage eKYC to streamline policy issuance and claims verification. Telecom operators utilise eKYC for SIM card activations and subscriber verification. Similarly, eKYC is making its mark in sectors like healthcare, e-commerce, and fintech, offering immense benefits in terms of efficiency and compliance.

Compliance and Privacy Considerations for eKYC

As with any process involving personal data, eKYC must adhere to strict regulations and privacy guidelines. Governments and regulatory bodies impose compliance requirements to protect customer privacy and prevent data misuse. Organisations implementing eKYC must ensure compliance with data protection laws, consent requirements, data retention policies, and secure data handling practices. Transparency in data usage and providing customers with control over their data are crucial aspects of eKYC compliance.

Best Practices and Success Factors for Implementing eKYC

Successful implementation of eKYC requires careful planning and adherence to best practices. Organisations should invest in robust and scalable eKYC solutions that align with their specific needs and compliance requirements. Collaborating with trusted technology partners and ensuring integration with existing systems is vital. Additionally, organisations must provide sufficient training to employees involved in the eKYC process and communicate the benefits and security measures to customers.

Future Trends and Innovations in eKYC

The field of eKYC continues to evolve with ongoing advancements in technology and regulations. Future trends include the integration of blockchain for enhanced data security and immutability, the use of decentralised identity frameworks, and the expansion of biometric authentication methods. Additionally, the incorporation of AI-driven analytics and real-time monitoring will further strengthen fraud detection capabilities.

Addressing Concerns and Misconceptions about eKYC

While eKYC offers numerous advantages, concerns and misconceptions may arise. Privacy concerns, data breaches, and the misuse of personal information are among the common worries. It is essential for organisations to adopt robust security measures, educate customers about data protection practices, and maintain transparency in their eKYC processes. Compliance with regulatory frameworks and obtaining proper consent from customers can help address these concerns.

The Role of AI and Biometrics in eKYC

AI and biometric technologies play a pivotal role in eKYC. AI algorithms analyse customer data, verify documents, detect anomalies, and facilitate decision-making in real-time. Biometrics, such as facial recognition, fingerprints, and iris scans, enable accurate and secure identity verification. The integration of AI and biometrics in eKYC ensures a high level of accuracy, minimises manual intervention, and enhances the overall customer experience.

Balancing Convenience and Security: User Experience in eKYC

While prioritising security, organisations must also focus on delivering a seamless and user-friendly eKYC experience. A well-designed and intuitive user interface, clear instructions, and responsive support can make the process easier for customers. Organisations should aim to strike a balance between security measures and customer convenience, ensuring that the eKYC process is efficient, quick, and hassle-free.

In conclusion, eKYC has emerged as a game-changer in customer verification, simplifying and digitising the onboarding process. By leveraging technology and adhering to regulations, organisations can enhance security, reduce fraud, and improve the overall customer experience. As eKYC continues to evolve, businesses across various industries are embracing its benefits, paving the way for a more secure and efficient digital landscape.

Learn more HERE about how Galaxkey has integrated biometric eKYC into its platform to enhance security and customer experience.